Hello, and welcome fellow Squido Lensmasters! For those who aren't travelling here by

blog hop and don't know what

Squidoo is, it's just a place where you can make nifty little web pages about any topic you choose, and maybe earn a little money for yourself or a charity in the process.

So Squidoers, have you finished your Taxes yet? If you are wondering if you have to report your Squidoo earnings, and how the heck you report them if you do, this post may help (though note, I'm not a tax expert...this is just the answers I came to through my own research as I tried to figure out things.).

I donate everything to charity, and none of it ever comes into my pocket, so I don't have to report it (I suppose it's possible I could write it off, but right now I'm not earning enough to make that worth the effort). But I make money from some other online endeavors, like affiliate programs,

taking surveys, and selling my art through

PODS like

Zazzle and

CafePress to have to report those. None of it makes very much, but the IRS still expects me to report it, and doesn't make it easy to do so!

The IRS expects you to report income from odd jobs, like babysitting, mowing lawns, and yes, earning money through Squidoo.

And what you have to do to report it depends on what you make and whether it is considered hobby income or self-employment income (

find out here).

Some People Don't Have to File Taxes:

If your income from all sources (including odd jobs), is less than a certain amount, then you don't have to file taxes. And if you don't have to file taxes (and choose not to), and your income from odd jobs is either under $400 or considered hobby income, then you don't have to worry about any of this. (But if you choose to file I believe you still have to report it).

See if this applies to you here.

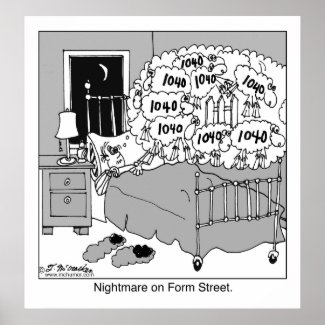

If you earned less than $400...

If you earned less than $400 total from all your odd jobs, but have other income, you'll need to report it (though you won't have to pay Self-Employment Tax). If you earn money from something that can be considered a hobby, you can report it on line 21 on form 1040EZ. If its not a hobby I believe you will need to use form 1040 (not 1040-EZ) to file your taxes. You will need to fill out Schedule C or C-EZ, which tally your net profit (it's a very simple form). The

net profit goes on line 12 of Form 1040. Is Squidoo a hobby? That I can't answer for you,

but this site may be helpful.

If you earned more than $400...

If you earned more than $400 from all your odd jobs, you will be paying self-employment tax, unless what you do can be

considered a hobby (in which case, it can go on line 21 on form 1040EZ). If this is not hobby income you cannot use Form 1040-EZ--you have to use Form 1040. You will need to fill out Schedule C or C-EZ, which tally your net profit (it's a very simple form). The

net profit then goes on line 12 of Form 1040. You will also need to attach Schedule SE to calculate the Self-Employment tax.

If you earned more than $600 from any one source...

If you earned more than $600 from Squidoo or any other odd job provider, they have to file a

1099-misc form, and will be sending you a copy which you will include with your taxes. You cannot use Form 1040-EZ unless what you do can be

considered a hobby (in which case, it can go on line 21 on form 1040EZ). If it's not hobby income you will have to use Form 1040 (their might be other forms you can file with also that I'm not aware of). You will need to fill out Schedule C or C-EZ, which tally your net profit (it's a very simple form). The

net profit then goes on line 12 of Form 1040. You will also need to attach Schedule SE to calculate the Self-Employment tax.

Whew! On the

IRS page about this subject, they complain about the lost revenue from people who don't report this type of income. Well, shesh, if they made more simple and obvious how to report this stuff, maybe more people would.

BIG IMPORTANT NOTE: I'm not a tax expert,I've just researched this myself and may be dead wrong! I've already had to change info on this (added info on hobby earnings). If you want to be absolutely sure to be right on this you'll just have to hire a real tax expert, or wade through the IRS website yourself. However, the sources I got these might be tax experts (or not), and I list these below :-)

(This was great except they had a typo and called form 1040 form 10)